Almost all businesses outsource their payroll services. A business can have several reasons or objectives to meet. However, the result should always be better service to the employee and reduced cost and effort for the employer.

For the employer, the benefits can be to reduce their in-house training, concentrate on their core business or ensure that they are providing the best services to their employees. The benefits to the employee should be access to knowledgeable resources. This can be through personal contact or employee self-service.

Business payrolls are complicated. Assorted taxes must be filed consistently and accurately to applicable regulatory agencies. These regulations are in a constant state of change. To be an expert resource for employees is a tremendously difficult task. To take the role of the expert on these changing regulations creates a business risk that is unnecessary.

Take for instance paying overtime. It gets complicated. As the Enlightened Employer states in the post Company Payroll Policy for Overtime, “It seems like overtime issues never cease… if it isn’t one thing, it’s another. But with money, productivity and safety at stake, it’s too important to just wing it. That’s why — aside from the obvious issues of when to pay time-and-a-half, when to pay double time, and who qualifies for the higher rates — your company needs a well thought out payroll policy to address other overtime factors.”

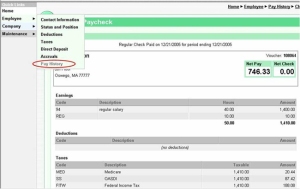

An outsourced payroll service should provide the employer the benefit of knowledgeable resources available through personal access. The employee is the ultimate beneficiary of this level of service. In addition the payroll service should offer self-service. Payroll Unlimited Inc. provides Employee Self Service as part of their Online Payroll service. Payroll Unlimited recognizes the continued growth in users’ expectations for self-service by providing secure online access to:

- Pay History

- Contact Information

- Position & Earnings

- Deductions

- Taxes

- Direct Deposit Information

- Accruals

However, a business can be disappointed after choosing a payroll service provider. The disappointment will set in when support is needed from the provider. That is the time when a business can find that the ‘personal touch’ is missing in their chosen provider. Support from a payroll service provider can be hard to reach and, when finally reached, lacking in knowledge and quality. An employer should choose a payroll service that answers the phone with a live person.

To learn more, access your free report “How to Reduce Labor Cost and Improve Communication in Your Company”,